Federal Budget 2018-19: 'This Time It’s Personal'

The Federal Government and the nation’s fiscal position have become the beneficiaries of an unexpected windfall – primarily in the form of higher tax revenue due to the improved performance of the domestic and global economies (and the adoption of some conservative economic forecasts a year ago).

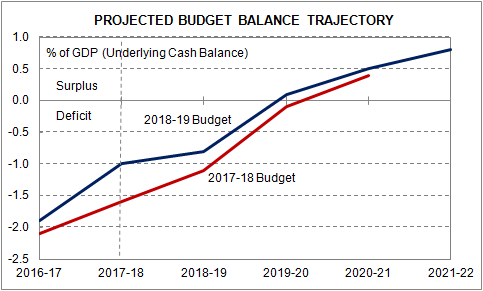

In the Budget, the Government has largely ‘banked’ this windfall in the early years – allowing for a 2018-19 deficit of $14.5b (or 0.8% of GDP) followed by a small $2.2b (or 0.1% of GDP) surplus in 2019-20. The return to surplus, therefore, comes one year earlier than previously projected. However, it’s in the year 2020-21 and beyond that the policy decisions taken in this Budget incur the greatest net cost, thereby crimping future surpluses.

As referenced in our title, the centrepiece of the Budget is personal tax relief via the seven-year Personal Income Tax Plan. That relief is initially modest and targeted to lower and middle income earners yet becomes more substantial via the ‘promise’ of more significant threshold and bracket changes from 2022-23. These measures, along with the scrapping of the Medicare Levy increase scheduled for next year, clearly shift the Government’s policy focus from company to personal tax cuts (although the Government has retained the commitment to last year’s ten-year Enterprise Tax Plan). There is an obvious political motivation here.

In terms of new initiatives, the big ticket items are $24.5bn (or 1.3% of GDP) of new transport infrastructure spending as part of the existing 10 year program (although this is accounted for as an off-budget item) as well as initiatives in relation to aged care, the environment and health care.

For the economy, the Budget provides a little extra stimulus to underpin what we believe is an already improving trajectory. Accordingly, it adds to the conviction that the economy will reach (if not exceed) 3% real GDP growth during 2018-19. The ratings agencies should also be encouraged by the earlier return to surplus - further diminishing the (low) prospect of a ratings downgrade.

Overall, the Budget has benefited from a cyclical economic improvement. Hence, its sustainability is not assured. However, there is also a clear case for easing household financial pressures (after an extended period of weak wage growth) and improving the nation’s infrastructure. The Budget balances these competing demands, prioritising a return to surplus while back-ending (and taking off-budget) the cost of new initiatives.